One of the main objectives for HR teams today is improving employees’ well-being, job satisfaction and sense of belonging. When it comes to employee branding and investing in your workforce’s talent, several strategies exist. Among these is developing and implementing a corporate benefits programme.

Table of Contents

What are corporate benefits?

Corporate benefits are incentives and other forms of compensation provided to employees in addition to their salary. The main purpose of these is to improve staff well-being. These benefits range from mandatory benefits (maternity and paternity leave) to pension plans. They also include health insurance, paid leave, paid holidays, career development opportunities and training, among others.

Why are corporate benefits important?

Corporate benefits are essential for increasing employee satisfaction and well-being, as well as for raising productivity. Furthermore, benefits can also be a key tool for attracting and retaining talent, contributing to a company’s competitive edge, and reducing the costs associated with recruiting and acquiring new employees.

The relevance of corporate benefits lies in their ability to enrich the employee’s experience, demonstrating that the company they work for values their well-being and is committed to investing in their future.

What types of benefits exist?

Corporate benefits vary according to the labour laws of each country. Therefore, if your company operates outside Spain, we recommend that you consult that country’s current legislation. Nevertheless, and in general terms, the following are the the most common corporate benefits in our country:

- Health insurance: Medical coverage that may or may not include dental care.

- Occupational insurance: Coverage for accidents or injuries at work.

- Maternity and paternity leave: Paid time off for new parents.

- Bank holidays: Paid national or regional days off in accordance with the law.

- Pension or retirement schemes: Pension schemes offered by employers.

- Sick days: Paid days off for illness.

- Education and professional development: Training and professional development. Optional but valuable for employee retention.

- Wellness programmes: Social perks such as gym memberships, flexible working hours, or discounts. Usually optional.

- Transport: Provision for own transport, discounts on travel tickets or free parking.

Corporate benefits: Their impact on companies

Corporate benefits offer many positive upsides for both employees and companies. Beyond the obvious advantage of improving the image of the organisation and the corporate environment, there are other more objective consequences. Read on to find out what they are.

- Tax base reduction: Some company benefits are tax-exempt or receive favourable tax treatment. For example, certain insurances (medical or dental) may be exempt from personal income tax (IRPF) for employees, which reduces the tax base on which taxes are calculated.

- Exemption from contributions: Benefits such as meal vouchers, transport or pension contributions may be exempt from personal income tax (IRPF) subject to statutory limits. As the value of these benefits is not included within the employee’s gross salary, less tax needs to be paid.

- Increased financial efficiency: Employees who receive company benefits can experience an increase in their well-being without a significant increase in their tax burden. Companies can increase the net salary of their employees without increasing payroll costs.

How do I set up a corporate benefits programme?

Now that you know the reasons why you need a benefits plan, it’s time to get down to the business of creating a programme. But, as the theory is often much more appealing than the practice, let us help you and pave the way for you to create your own benefits project:

- Set your budget: Be clear about the total budget available and the amount that can be allocated to each employee. This will help you define and restrict the benefits that are within your scope.

- Identify your workforce’s needs: Today, as many as four different generations can coexist within one workplace, and each generation has its own different needs. While more experienced employees tend to prefer benefits associated with financial well-being, younger employees are more inclined to prefer benefits which impact on their day-to-day life, such as meals, or that focus on their future, such as further education or training.

- Draw up your list of benefits: This is the time to decide whether to set up one single company-wide plan or to implement several different plans. While a single plan may be easier to implement, to get the most out of it, we recommend that a benefits plan should be as individualised as possible.

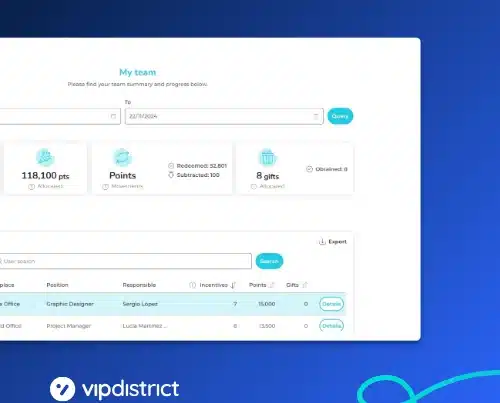

- Choose a platform: A platform is needed to ensure employees can access their benefits. Select it carefully. It should be a space that centralises all the benefits, whilst also making programme administration as easy as possible.

- Communicate your benefits plan: There is no point in investing in a programme if your employees don’t know it exists. Use your internal communication platform to make your staff aware of the new benefits and, in the same way, let those applying for job vacancies in your organisation know about it.

- Measure the results: For HR, analysing results is always crucial to understanding how successful a plan has been. Once you have your benefits programme in place, you will need to identify indicators such as employee engagement, loyalty, retention and job satisfaction. This will then help you discover which areas have worked and which still need improvement.

How do I evaluate the Return on Investment (ROI) of my benefits package?

How you measure the ROI of your employee benefits will vary depending on what your objectives are. Are you looking to reduce turnover? Increase job satisfaction? Or attract talent? Once you have set your goal, it is essential to track the results against the costs to determine if the return is as expected.

There are two main methods for calculating the employee benefits ROI:

- Financial ROI, based on economic data

- Non-financial ROI, based on factors such as employee satisfaction.

Financial ROI is more straightforward to calculate, as it is based on economic data. The basic formula for determining financial ROI is as follows:

ROI=(profit-cost / cost)×100

However, the true return on investment in employee benefits can be more complex to measure. The positive effects of these benefits are not always immediately apparent. Their impact can take time to become obvious and it is often challenging to measure more intangible objectives, such as employee happiness.

In conclusion, corporate benefits are a key strategy to improving employee well-being and strengthening a company’s competitiveness. Not only do they increase employee satisfaction and retention, but they can also offer financial benefits for both the company and their employees.

New to Vip District? Contact us and find out what our platform has to offer!